401k asset allocation calculator

Her areas of expertise include administration and daily recordkeeping of 401k and Profit Sharing plans compliance testing and preparation of government forms. Asset Allocation Calculator The asset allocation is designed to help you create a balanced portfolio of investments.

Investing Basics For Physicians With Little Time Or Experience Part Ii Learn From Pof How To Choose The Right Funds F Investing Bond Funds Investment Accounts

Your age ability to tolerate risk and several other factors are used to calculate a desirable mix of stocks.

. After all it is one of the main factors that leads to your overall returnseven more than. Thats why its generally. Help you rebalance your portfolio if needed.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. But invest 401 k money at a 7 return and youll have over. Register to access Advisor Solutions proprietary wealth management technology.

PIMCO Has Been Helping Investors Achieve Their Goals For More Than 50 Years. Automated Investing With Tax-Smart Withdrawals. Traditional 401k Retirement calculators.

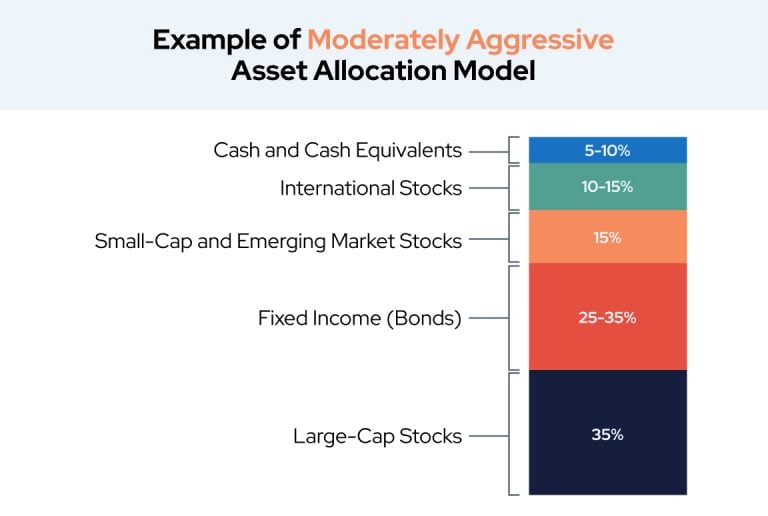

If you need to tap into retirement savings prior to 59½ and want to avoid an early distribution penalty this calculator can be used to determine the allowable distribution amounts under. Crafted by Experts and Designed to Capitalize on Ever-Changing Markets. Asset allocation is a very important part of creating and balancing your investment portfolio.

The more sophisticated way to accomplish this is to look at your entire retirement portfolio at once. This is one of many easy. Ready To Turn Your Savings Into Income.

With this tool you can see how prepared you may be for retirement review and. 10 Best Companies to Rollover Your 401K into a Gold IRA. Hopefully you have more than this saved for.

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. You can reach Nicole via. Target asset allocation and provide suggestions to.

Well compare your current asset allocation to your. Current 401 k Balance. The old rule of thumb used to be that you should subtract your age from 100 - and thats the percentage of your portfolio that you should keep in stocks.

Ad Have a 500000 portfolio. Over 90 percent of investment returns are determined by how investors allocate their assets versus security selection market timing and other factors. Uninvested it could be worth less than half that in 30 years factoring in inflation.

Lets say you have 10000. Protect Yourself From Inflation. According to research from Transamerica this is the median age at which Americans retire.

Download this must-read guide from Fisher Investments. Access Advisor Solutions proprietary wealth management technology. Your financial plan at 65 when you may have many more.

Learn how our easy-to-use investment calculators and retirement tools can help you strengthen financial strategy. This means that your needs will generally change as your retirement goes on so your asset allocation should too. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account.

See How American Funds Can Help Improve Client Outcomes Through Objective-Based Investing. Calculate Your Potential Investment Returns With the Help of AARPs Free Calculator. The Planning Guidance Center helps make it easy to get a holistic view of your financial plan from one place.

Use SmartAssets asset allocation calculator to understand your risk profile and what types of investments are right for your portfolio. Investing calculators tools. The asset allocation calculator is a great place to start the analysis in building a balanced portfolio.

For example if your 401k is entirely invested in stocks and is worth 80000. Use this calculator to. Use this tool to help create a consistent income stream by investing in different bonds with staggered maturity dates.

Ad Learn More About American Funds Objective-Based Approach to Investing. Ad Understand The Potential Returns You Might Receive From Investments. Your age ability to tolerate risk and several other factors are used to.

Ad Six Risk-Based Portfolios to Target a Range of Return and Risk Objectives. The asset allocation is designed to help you create a balanced portfolio of investments. For example if you earn 2000week your annual income is calculated by.

Ad Learn More About American Funds Objective-Based Approach to Investing. Generate trading ideas with our prebuilt and custom options screener. Ad Leverage Our Time-Tested Investment Process And Active Management Expertise.

See How American Funds Can Help Improve Client Outcomes Through Objective-Based Investing.

5 Rules Of Portfolio Diversification For Passive Income Dividend Investors Learn How To Properly Diversify Y Stock Trading Strategies Dividend Stock Portfolio

Personal Finance Spreadsheet Bundle Google Sheets Etsy Espana

Retirement Tips Budgeting Money Money Saving Tips Money Management

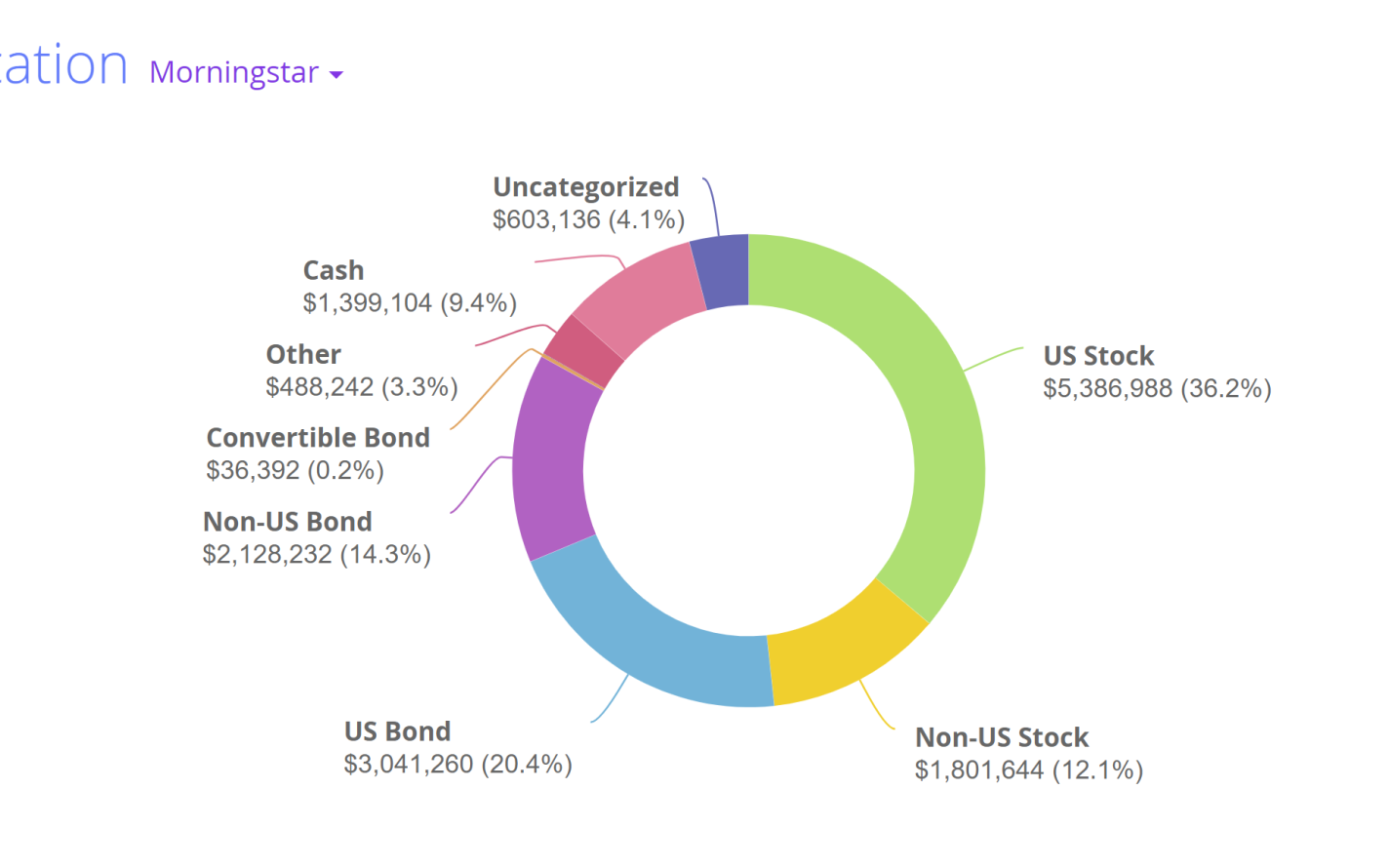

Asset Allocation Features Capitect

Pin By Arien On Besparen In 2022 Investing Ways To Save Money Ways To Save

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Advanced Investing Books Quantitative Investment Strategy Investing Books Investing Investment Advice

Did I Just Retire At Age 52 Video In 2022 White Coat Investor Retirement Planning Early Retirement

Pin By James Moore On Ways To Save Money Money Saving Strategies Saving Money Saving Money Budget

How To Manage Your Portfolio S Asset Allocation At Any Age Smartasset

What Is Asset Allocation How Is It Important In Investing

Partners In Business Tip Log Your Spending Saving Money Challenge Biweekly Savings Account Savings Bank

How Much Should You Save 50 20 30 Rule

How To Invest Your Ira Fidelity Investing Investment Portfolio Saving For Retirement

Pin Page

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-04_2-dbcdce95e61347e5bdd2df3bfabb4023.png)

How To Achieve Optimal Asset Allocation